Citibank SWOT analysis – SWOT analysis of Citibank: Citibank can be described as an organization that provides financial services and is part of the Citi Group. Its headquarters are located in New York City, Citibank is the end for consumers of Citigroup. The main areas for Citibank comprise credit card mortgages, bank loans, mortgage insurance, and line of credit.

The bank operates activities in over 200 countries and has close to 2500 branches in the most prestigious cities throughout the world. The company offers a broad array of banking services and services, including consumers financial services, such as banking and credit corporate and investment banking and trade brokerage, securities, and services for securities and wealth management services to corporate and retail customers, as in commercial establishments.

Citibank is associated with outstanding service and provided a steady run for local financial service institutions in the majority of the areas it is present. The bank’s ability to satisfy both retail and institutional consumer customers with the same core products has earned the acclaim of critics around the world to the institution. This article focuses on the details of the SWOT analysis of Citibank in depth.

Citibank fun facts: Citibank was founded in 1812 as the City Bank of New York, and later became First National City Bank of New York. The bank has 2,649 branches in 19 countries, including 723 branches in the United States and 1,494 branches in Mexico operated by its subsidiary Banamex.

About Citibank – SWOT analysis of Citibank

Contents

- 1 About Citibank – SWOT analysis of Citibank

- 2 Citibank Competitors

- 3 SWOT analysis of Citibank – Citibank SWOT analysis

- 4 Strengths of Citibank – Citibank SWOT analysis

- 5 Weaknesses of Citibank – SWOT Analysis Of Citibank

- 6 Opportunities of Citibank – Citibank SWOT analysis

- 7 Threats of Citibank – SWOT analysis of Citibank

- 8 Overview Template of Citibank SWOT analysis

- 9 Conclusion

[wp-svg-icons icon=”office” wrap=”I”] Company: Citibank

[wp-svg-icons icon=”user” wrap=”I”] CEO: Jane Fraser

[wp-svg-icons icon=”user” wrap=”I”] Founder: Samuel Osgood

[wp-svg-icons icon=”calendar” wrap=”I”] Year founded: 16 June 1812, New York, New York, United States

[wp-svg-icons icon=”location-2″ wrap=”I”] Headquarters: New York, New York, United States

[wp-svg-icons icon=”stats” wrap=”I”] Annual Revenue: 7,430 crores USD

[wp-svg-icons icon=”bars” wrap=”i”] Profit | Net income: 1,100 crores USD

[wp-svg-icons icon=”users” wrap=”I”] Number of employees: 5,500

[wp-svg-icons icon=”pie” wrap=”i”] Products & Services: Personal Loans and Lines of Credit, Purchase Mortgages, Refinance Mortgages, Home Equity Loans and Lines of Credit, Individual Retirement Accounts (IRAs), Self-Directed Trading, Managed Investment Portfolios, Private Banking.

[wp-svg-icons icon=”globe” wrap=”I”] Website: online.citi.com

Citibank Competitors

[wp-svg-icons icon=”pacman” wrap=”I”] Competitors: Wells Fargo | Bank of America | Goldman Sachs | JPMorgan Chase & Co | CIT Group. | Standard Chartered Bank

SWOT analysis of Citibank – Citibank SWOT analysis

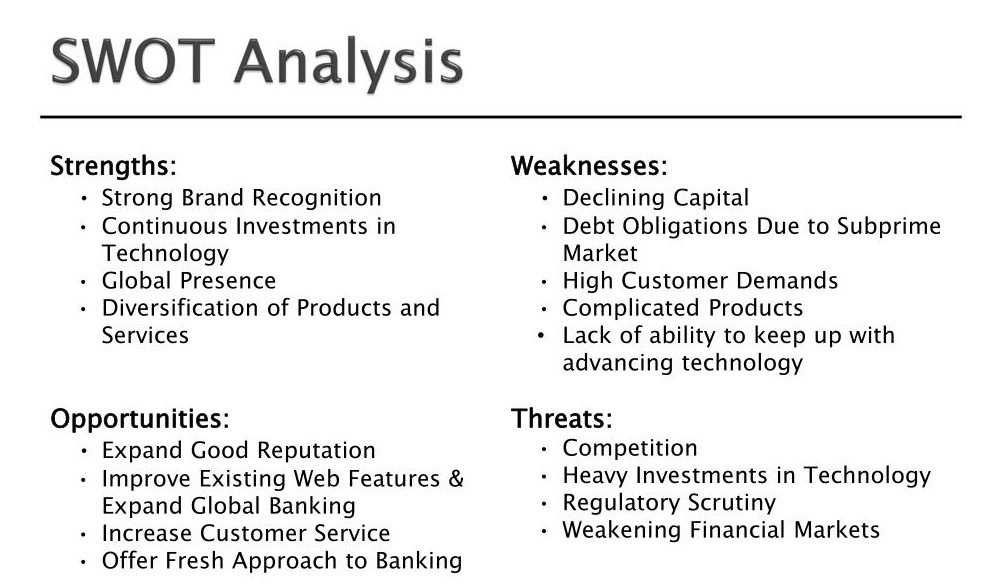

SWOT Analysis Of Citibank is brand-based. SWOT Analysis of Citibank evaluates the brand’s strengths, weaknesses, opportunities, and threats. Advantages and disadvantages can be attributed to internal factors while opportunities and threats can be attributed to external factors. We will be discussing Citibank’s SWOT Analysis. Below is the detailed SWOT Analysis of Citibank.

Let’s talk about Citibank’s SWOT assessment.

Strengths of Citibank – Citibank SWOT analysis

- Predominance across segments: The bank is present in both retail and institutional segments. The retail banking services offered by Citibank cover the entire range of banking products, including credit cards and loans. Foreign exchange trade and sales of equity, derivative services, fixed income Prime brokerage, advisory services for equity research, investment banking fixed income research trade finance, corporate lending and private baking, cash management as well as security services are among the services offered by commercial baking clients with high net worth.

- Network: Citibank has one of the most extensive banking networks around the globe. In reality, Citibank has often gone into its records to say that its large network has helped the bank get through the financial crisis more effectively than other banks. It also helped the bank to ensure the consistency and quality of its profits.

- The company is trimming its operations: When the global financial recession grew worse in the west, Citibank took a decision to cut its business in order to evaluate every one of its customers on their performance to the company. Utilizing this analysis as a guide, Citibank decided to reduce its number of institutional customers from 32,000 to 14,000 in 2016, opting to focus on the most profitable customers.

- Strategy for advertising: Citibank recently revamped its marketing strategy in emerging economies such as India as well as South East Asia choosing to make use of the bank’s primary mission as the basis of the marketing strategy. They’ve also looked at sponsoring primetime programming on the most popular television channels and also sports events like cricket’s Indian premier league, which has helped increase the visibility and visibility of their company’s brand.

- The solid customer connection: Citibanis an institution of finance with excellent relationships with its customers. The customer’s requirements are monitored regularly as well as they are able to provide benefits offered by the bank to the needs of each customer wants. Furthermore, the bank offers a dependable customer support team available around the clock, and also provides the services of a personal banker for all of their valued customers.

- Strategist: The bank has been aware of the fact that the distribution of financial services is restricted and adopting a macros perspective in the expansion process, particularly in emerging economies does not work. Therefore, the bank has focused on cities, and not regions in planning its expansion, which has allowed it to gain a foothold in emerging economies.

Weaknesses of Citibank – SWOT Analysis Of Citibank

- Massive Volume: The bank has one of the biggest networks in the world. It operates in more than 200 countries with 2500 branches. The bank has approximately 2 million accounts in these countries. This makes it a challenging job to manage and the handling of these volumes isn’t straightforward.

- High investment in sustainable development: Citibank has been involved in numerous initiatives relating to sustainability. their sustainability plan is allocated an amount of 100 billion dollars over a period of 10 years. In the current recession, this is not an option in the near future.

Opportunities of Citibank – Citibank SWOT analysis

- Growing in the emerging countries: There is a shift in the focus of developed economies to emerging ones in the sector of financial services and large numbers of multinational banks are shifting towards BRIC countries. Populations that are young, have low labor costs, an expanding middle class, and a greater emphasis on infrastructure are driving this expansion.

Threats of Citibank – SWOT analysis of Citibank

- Competitors: The main competitors of Citi Bank are Bank of America, Standard Chartered Bank, and Royal Bank of Scotland.

- The risks of the emerging markets: Though there is a number of growth possibilities for emerging countries, there’s equally a lot of risk. They include the small current size of the market and high volatility in the market along with political turmoil.

You May Also Like:

- Oriflame SWOT analysis – SWOT analysis of Oriflame

- Nirma SWOT analysis – SWOT analysis of Nirma

- Neutrogena SWOT analysis – SWOT analysis of Neutrogena

- ASOS Swot Analysis – Swot Analysis of ASOS

- Dabur Amla SWOT analysis – SWOT analysis of Dabur Amla

Overview Template of Citibank SWOT analysis

Conclusion

In recent times, Citi has taken some significant steps to make its operations more efficient, smarter, and more secure.

While it has restricted its efforts to the primary areas in which it operates it has also increased its digitalization process.

In addition to being the biggest credit card issuer around the globe, The brand is well-known for many other reasons.

The company’s primary focus is focused on the US, Asia, and Mexico. It has formed partnerships with several retail companies and is trying to form more alliances.

It also has struck an important and significant collaboration with Paypal. However, the image of the company was damaged by the FIFA scandal, and it accepted a substantial fine for the lack of supervision at Banamex US.

There are still significant opportunities for Citibank within the Asian markets as well as in other key emerging economies.

This is the SWOT analysis of Citibank. Please let us know if you have additional suggestions to add.

[wp-svg-icons icon=”bubbles” wrap=”i”] Let us know What do you think? Did you find the article interesting?

Write about your experiences and thoughts in the comments below.