SWOT analysis of Standard Chartered Bank – Standard Chartered Bank SWOT analysis: Standard Chartered is a British multinational bank as well as a financial service firm with its head office in London, England. It has a global presence and is present in more than 70 countries and has over 86000 workers. It has been the principal patron of Liverpool football club since the year 2010 which is why it’s proud to see its name on the iconic red shirt. They have listed on London as well as Hong Kong Stock Exchanges in addition to the National as well as Bombay Stock Exchanges located in India.

It is the country’s most important internationally-based bank, having 100 branches spread across 43 cities. The bank has been operational since 1858. The main segments of the client base include private banking, institutional banking commercial, commercial banking, as well as retail banking. It also operates numerous subsidiaries that are operating in India such as Standard Chartered Securities (India) Ltd; Standard Chartered Private Equity Advisory (India) Private Limited and so on.

Standard Chartered recently refreshed its brand identity after eight years of “Here to help” and is now posing the challenge of “Good enough will not alter this world” and has plans to solve problems and make an impact that is positive for the entire world.

Standard Chartered Bank fun facts: Standard Chartered Bank is India’s largest international bank (in terms of branch network) with 100 branches in 42 cities.

About Standard Chartered Bank – SWOT analysis of Standard Chartered Bank

Contents

- 1 About Standard Chartered Bank – SWOT analysis of Standard Chartered Bank

- 2 Standard Chartered Bank Competitors

- 3 SWOT analysis of Standard Chartered Bank – Standard Chartered Bank SWOT analysis

- 4 Strengths of Standard Chartered Bank – Standard Chartered Bank SWOT analysis

- 5 Weaknesses of Standard Chartered Bank – SWOT Analysis Of Standard Chartered Bank

- 6 Opportunities of Standard Chartered Bank – Standard Chartered Bank SWOT analysis

- 7 Threats of Standard Chartered Bank – SWOT analysis of Standard Chartered Bank

- 8 Overview Template of Standard Chartered Bank SWOT analysis

- 9 Conclusion

[wp-svg-icons icon=”office” wrap=”I”] Company: Standard Chartered plc

[wp-svg-icons icon=”user” wrap=”I”] CEO: Bill Winters

[wp-svg-icons icon=”user” wrap=”I”] Founder: Chartered Bank of India | Australia and China, Standard Bank

[wp-svg-icons icon=”calendar” wrap=”I”] Year founded: 1969, London, United Kingdom

[wp-svg-icons icon=”location-2″ wrap=”I”] Headquarters: London, England, UK

[wp-svg-icons icon=”stats” wrap=”I”] Annual Revenue: USD$14.7 billion

[wp-svg-icons icon=”bars” wrap=”i”] Profit | Net income: USD$2.3 billion

[wp-svg-icons icon=”users” wrap=”I”] Number of employees: 81957

[wp-svg-icons icon=”pie” wrap=”i”] Products & Services: Credit cards | Consumer banking | Corporate banking | Investment banking | Mortgage loans | Private banking |Wealth management

[wp-svg-icons icon=”globe” wrap=”I”] Website: www.sc.com

Standard Chartered Bank Competitors

[wp-svg-icons icon=”pacman” wrap=”I”] Competitors: Royal Bank of Scotland | Bank of America | HSBC | Aetna | Deutsche Bank | Citibank | United Overseas Bank | ICICI Bank | Kotak Mahindra | Axis Bank | Yes Bank

SWOT analysis of Standard Chartered Bank – Standard Chartered Bank SWOT analysis

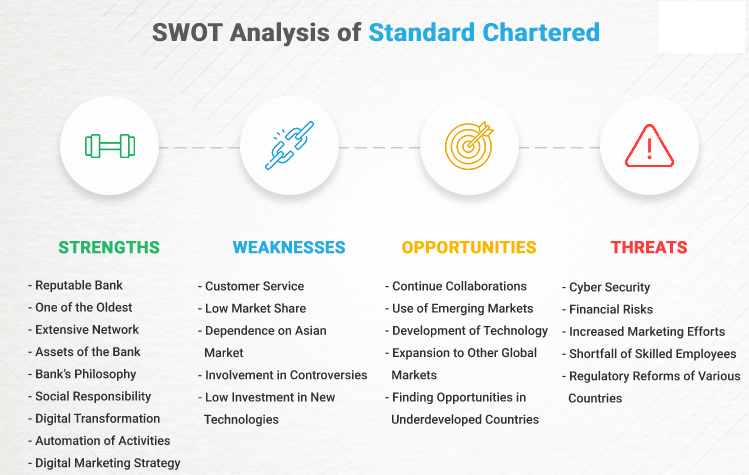

SWOT Analysis Of Standard Chartered Bank is brand-based. SWOT Analysis of Standard Chartered Bank evaluates the brand’s strengths, weaknesses, opportunities, and threats. Advantages and disadvantages can be attributed to internal factors while opportunities and threats can be attributed to external factors. We will be discussing Standard Chartered Bank’s SWOT Analysis. Below is the detailed SWOT Analysis of Standard Chartered Bank.

Let’s talk about Standard Chartered Bank’s SWOT assessment.

Strengths of Standard Chartered Bank – Standard Chartered Bank SWOT analysis

- A strong image of the brand as well as a footprint across the globe

A strong branding presence, top-quality services, and solid financial capabilities have contributed to helping Standard Chartered create a reputable image of its brand. It is the sponsor of some of the world’s most revered football teams in the world and stands up for the causes it is firmly committed to such as, for example, it has stopped funding power plants that use coal, and it runs a global program known as Goal which helps create a better future for women and girls by providing the sport of life and knowledge training, which promotes sustainability and growth.

Standard Chartered is the only global brand that operates in all ten ASEAN countries and is proud of its diverse collection of people as well as its culture and global network that has contributed to an understanding of the distinct regions and the different needs across markets.

- The focus is on emerging market

The bank has made rapid progress to develop the African, Asian, and Middle Eastern local markets to identify potential growth opportunities and to help companies reach their financial goals. It provides unique products and services in the financial sector. services and a distinct service knowing the needs of markets with a variety of needs.

The bank’s profits of 80% are derived from emerging markets. The bank holds a large portion of its non-resident Indian market which it refers to as “Global Indian”, and the business was boosted through the acquisition of American Express purchase in the year 2008.

- Aim for sustainability

The sustainable philosophy that is the core value of Standard Chartered is based on the three values of Standard Chartered which include “Never settle”, “Do the right thing” and “Better together”. It is in support of the Sustainable Development Goals (‘SDGs’) and generates new opportunities by implementing this.

It balances the social, environmental as well as economic requirements of every country by assisting in financing the market energy requirements and balancing the low carbon economy, which guarantees that infrastructure development doesn’t hurt communities, and assists clients to find high-quality work opportunities that are in line with human rights.

Weaknesses of Standard Chartered Bank – SWOT Analysis Of Standard Chartered Bank

- A High Dependence on South East Asian Economies

Standard Chartered is tremendously dependent on Asia to earn its profits, generating about two-thirds of its revenues and the majority of its profit.

In 2017, the Southeast, as well as South Asia, contributed almost 27% of the revenues however, they only contributed 14% of the profit due to the high loss from bad loans. Vietnam is currently being impacted by air pollution. Vietnam’s capital was only able to enjoy 38 days of clean air in 2017.

As the governance reforms are changing, within these Southeast Asian countries banks will be required to incorporate compliance requirements alongside strategic strategies. The new generation of digital-only banks is gaining ground in the market. There is much demand for digitalization, and banks such as Singapore’s DBS Group are already capturing the market, so the competition is fierce.

- The low productivity of developed nations has been dragging down profits

In the US the US, the slow productivity growth has kept the interest rates low as well as the Federal Reserve Board cautious. Countries such as those the UK, Germany, and Spain are not performing well because of low investment and a general slowing down. The biggest issues faced by the advanced economies are inadequate demand, tax increases and reforms that are not implemented, the boom in oil prices, etc., and the risk of inflation and overheating. Without new investments or expansion opportunities profits from these advanced economies is actually minimal.

Opportunities of Standard Chartered Bank – Standard Chartered Bank SWOT analysis

- The possibility of a boost in technological advancements

The rapid development of technology like AI robotics, robots, and mobile cloud IOT could lead to a technological revolution that is driving productivity gains in any economy. The Philippines, as well as India, have benefited greatly by boosting exports of services with technology. Technology for any emerging economy interventions can assist in helping in the growth of the economy through the creation of new opportunities. an environment like this is a good one for Standard Chartered with growing demands for financial and investment services.

As technology advances such as big data analytics, it will be simpler to forecast the rate of success and failure of clients in the context of mortgages, mutual funds, etc. The risk that is taken will be at a minimum. The online banking industry is becoming more sophisticated, thanks to Chabot’s ability to keep customers interested and solve their issues. Standard Chartered can find good opportunities to improve the customer experience with technological solutions.

- Potential for growth for emerging market

The countries with high productivity like Vietnam, China, Taiwan, and India have more credit, stocks, and property markets and are also experiencing rising real exchange rates. Standard Chartered is well-positioned to profit from trade flows that flow between Africa, Asia, and the Middle East.

The Asian outlook remains stable, despite increasing tensions between the US and China. It also has higher current and fiscal balances in its accounts, and more Forex Reserves when compared with others Emerging Markets. India has favorable populations along with economic opportunities and, through Standard Chartered, is looking for opportunities to expand its new capabilities for retail and develop commercial banking franchises, etc.

The requirements for financial services in these countries are perfect for banks to make profits from these markets that are emerging.

Threats of Standard Chartered Bank – SWOT analysis of Standard Chartered Bank

- The macroeconomic environment is changing

Based on the global outlook for banking survey, the majority of bankers believe that costs will continue to rise over the three years ahead. The savings that are moderately sized are allocated toward cybersecurity and development initiatives. It is anticipated that the cost hike will be 2.1 percent in the next three years.

The tensions in the trade and USD strength are also impacting business sentiments in new markets of Japan as well as Europe. In the fourth quarter of 2018, it is anticipated that there will be more volatility from developments in the global economy, growth, and variations in prices of interest. Gold prices are also in the grip of the growing trade conflict. The metal’s value has diminished in the face of weaker Emerging markets In this volatile market environment, ensuring the stable quality of the asset is the primary goal for Standard Chartered Bank.

- geopolitical developments

The US has imposed a new round of tariffs that amount to $200 billion in Chinese exports. China has rejected the US’s invitation to discuss trade proposals. The trade tensions are growing. Oil prices are increasing in uncertainty as they are impacted by the increasing demand for oil continues to grow. The value of the GBP(Great Britain Pound) is caused by the expectation of the possibility of a “no-deal Brexit” being averted by compromises on both sides. In such a scenario, the risk of investing in a bank is huge. In the current political instability and instability, there isn’t a stable atmosphere in which the banking institution can continue their activities in these markets of strategic importance.

- Competitiveness in the market

The banks are faced with increased competition from market newcomers like digital banks as well as other institutions that offer high-tech, high-touch branch services. The challenges are rapidly evolving due to the changing behavior of customers and expectations, which are making banks invest in customer technology in order to stop leaks from customers. HSBC Bank, which is among the major rivals of Standard Chartered is planning to invest between $15 and $17 billion investments as it shifts from cost-cutting and growth. Standard Chartered will have to make smart decisions and invest to be ahead of its rivals.

You May Also Like:

- Cathay Pacific SWOT analysis – SWOT analysis of Cathay Pacific

- Air Asia SWOT analysis – SWOT analysis of Air Asia

- Vicco Turmeric SWOT analysis – SWOT analysis of Vicco Turmeric

- Tresemme SWOT analysis – SWOT analysis of Tresemme

- Rexona SWOT analysis – SWOT analysis of Rexona

Overview Template of Standard Chartered Bank SWOT analysis

Conclusion

On the basis of my study, I came to know that Standard Chartered Bank is performing well in India in the case of total assets and capital adequacy ratio. In some cases, Standard Chartered Bank is well than the other compared 5 private sector banks but in some cases, liquidity asset to total asset, return on asset, and dividend payout ratio ICICI Bank and HDFC Bank are better than Standard Chartered Bank. But being a foreign bank its overall performance is good and it seems that in future its performance will be increasing.

This is the SWOT analysis of Standard Chartered Bank. Please let us know if you have additional suggestions to add.

[wp-svg-icons icon=”bubbles” wrap=”i”] Let us know What do you think? Did you find the article interesting?

Write about your experiences and thoughts in the comments below.